SMM, February 5:

Price Review:

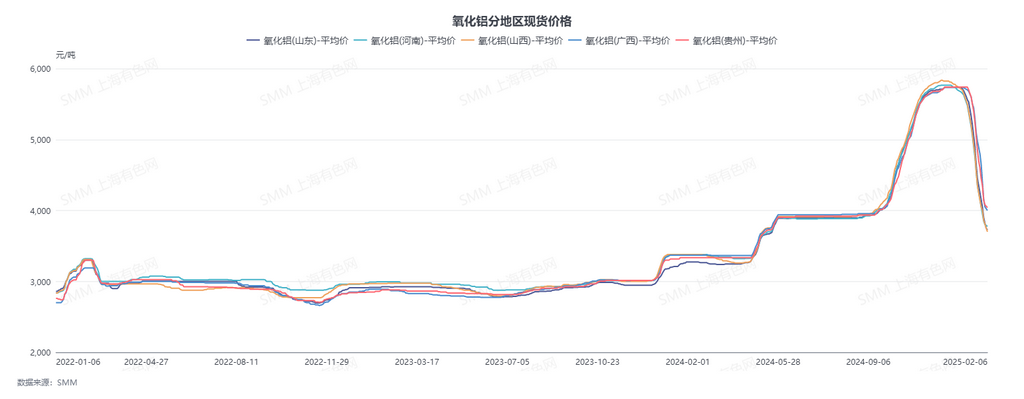

As of this Thursday, the SMM regional weighted index stood at 3,802 yuan/mt, down 294 yuan/mt from the week before the holiday on a YoY basis. Among them, Shanxi reported 3,700-3,750 yuan/mt, down 325 yuan/mt YoY; Henan reported 3,750-3,800 yuan/mt, down 175 yuan/mt YoY; Shanxi reported 3,600-3,800 yuan/mt, down 300 yuan/mt YoY; Guangxi reported 3,950-4,050 yuan/mt, down 400 yuan/mt YoY; Guizhou reported 4,020-4,060 yuan/mt, down 310 yuan/mt YoY; Bayuquan reported 4,660-4,740 yuan/mt.

Overseas Market:

As of February 5, 2025, FOB Western Australia alumina prices were $531/mt, with ocean freight rates at $19.30/mt. The USD/CNY exchange rate selling price was around 7.31, translating to an external selling price of approximately 4,624 yuan/mt at major domestic ports, 822 yuan/mt higher than domestic alumina prices, keeping the alumina import window closed. Four new overseas spot alumina transactions were recorded this week:

1) On January 24, 30,000 mt of alumina was transacted at $540/mt FOB Bunbury, Western Australia, for March shipment;

2) On January 27, 30,000 mt of alumina was transacted at $520/mt FOB Gladstone, Australia (eastern Australia) or $525/mt FOB Kendawangan, Indonesia, for March shipment;

3) On February 3, 30,000 mt of alumina was transacted at $527/mt FOB Gladstone, Australia (eastern Australia) or $531/mt FOB Western Australia, at the seller's choice, for late March shipment;

4) On February 5, 31,500 mt of alumina was transacted at $561/mt CIF Kakinada, India, sourced from eastern Australia, for late March shipment.

Domestic Market:

According to SMM data, as of this Thursday, the national weekly operating rate of alumina decreased by 0.36 percentage points from the week before the holiday to 86.94%. Among them, the weekly operating rate of alumina in Shandong decreased by 1.35 percentage points to 94.01%, mainly due to an increase in existing capacity; Shanxi's weekly operating rate remained flat at 80.60%; Henan's weekly operating rate remained flat at 69.17%; Guangxi's weekly operating rate remained flat at 93.94%. During the period, spot alumina transactions were relatively sluggish, but the transaction price center continued to decline. In Henan, 3,000 mt of alumina was transacted at 3,800 yuan/mt; in Guizhou, 3,000 mt of spot alumina was transacted at 4,080 yuan/mt; in Guangxi, 2,000 mt of spot alumina was transacted at 4,020 yuan/mt delivered to the plant; in Shandong, 10,000 mt of spot alumina was transacted at 3,980 yuan/mt delivered to Xinjiang; in Shanxi, 5,000 mt of spot alumina was transacted at 3,600 yuan/mt.

Overall:

Overall, in the short term, operating capacity for alumina continues to increase, and the spot alumina market remains relatively loose compared to earlier periods, with spot transaction prices continuing to decline. In the short term, there are no clear expectations for production cuts in alumina, and supply remains unchanged. However, some aluminum production cuts or technological transformation capacities in south-west China may gradually resume production, leading to a slight rebound in demand, though it is expected to be insufficient to reverse the relatively loose spot alumina market. Continued attention is needed on bauxite prices and supply conditions.